Exposure to PROMPT: Updated Calculations

This article provides an in-depth analysis of the $PROMPT caching profit model. It evaluates the profit differences and strategic choices between caching $PRIME and directly purchasing $PROMPT at the current stage. This helps investors make wiser allocation decisions between terminal valuation and market volatility.Reflection on $PROMPT Yield Calculations

For a year I’ve been sharing estimate yield figures for staking $PRIME and receiving $PROMPT which have been referenced often within the community. Evaluating these after post TGE, I’m happy that the estimates have been decently accurate:

The model estimates a total number of ‘PROMPT points’ = PRIME Locked Duration Multiplier. Cachers receive a proportionate amount of the total points based on their stake.

Comparing the model to 3 different wallets including my own, the model overestimated PROMPT received by ~20%. I attribute this to 2 reasons:

- I assumed 40% of PRIME circulated would be cached, whereas we went as high as 45%, meaning total amount of points was higher and thus more dilution.

- The total amount of PROMPT points is still uncertain, given some cachers may rolloff their cache or extend further which would decrease/increase total number of points respectively.

Outside of this, yield estimates are very dependent on both $PRIME and $PROMPT price – as $PRIME price falls, you’re incentivised to buy more tokens and cache as the yield is higher. Of course, ultimately the yield depends on the terminal valuation of $PROMPT.

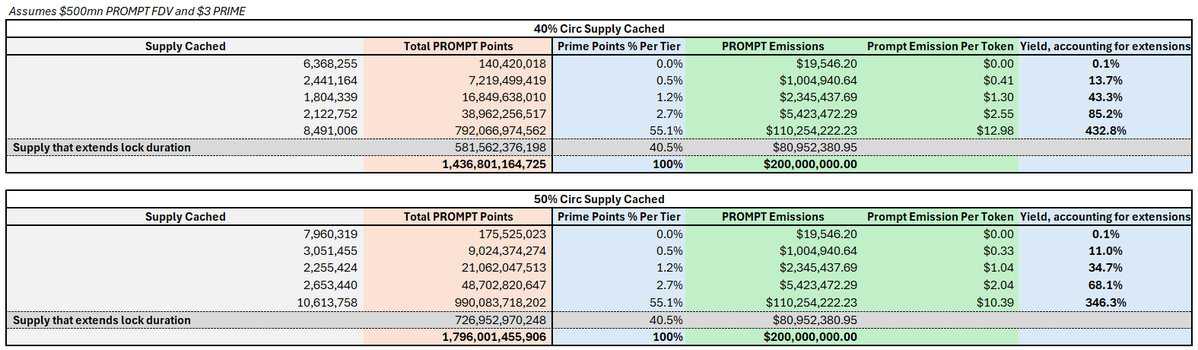

With more information now available after TGE, I believe the following table is likely the most accurate representation of yield for caching $PRIME. I have updated this to account for more PRIME staked (via more PROMPT points generated), and kept it at a $500mn FDV. Furthermore, I have added a new column to exclude the 28% proportion to the community that was airdropped at TGE:

TLDR: Max caching PRIME now would yield 106% over the next 797 days in PROMPT received.

Looking at the above, it is clear that the yield farm opportunity has diminished greatly since June 2024. This is obvious as the multiplier falls, and PROMPT points rise over time – the later you enter the game the less proportion of points available for you to earn. This is even more true after TGE as 28% of total supply has already been emitted, and we will see new supply be made available to claim on a weekly basis.

Caching PRIME vs. Buying PROMPT: Scenario Analysis

The below analysis compares two options market participants now have – whether to buy PROMPT in the open market, or whether to buy PRIME and cache, receiving PROMPT along the way. For this purpose we will assume that PRIME will be max cached at the 49.8x multiplier for 797 days quoted above.

Buying $1k of PRIME today would give you ~333 PRIME. Based on the table above, max staking this would yield you 333*39,690 points, i.e. 13.2mn points.

Given 400mn PROMPT tokens are to be distributed to all cachers based on 1.8tn total points generated, 13.2mn tokens should generate ~2,944 PROMPT tokens. Accounting that 28% of PROMPT has been distributed already, we will reduce this proportionally, i.e. the points should generate ~2,119 PROMPT. Note, I accept this math is not exact– as PROMPT distribution is based on how many points have been accrued at a given day. However the above is a simple and intuitive way to think about the yield and is ballpark correct.

The below table applies this number to valuation scenarios for PRIME and PROMPT at the conclusion of the caching period:

On the other hand, the math for someone who just buys PROMPT is more simple. Ultimately, assuming a $0.5 PROMPT price, you end up with 2,000 PROMPT tokens with a $1k investment, which is less than what you would get by buying PRIME and max caching.

Of course, the benefit of just buying PROMPT in the open market as of today is that you have the flexibility to take profits on PROMPT whenever a local peak arises.

Assume that PROMPT Valuation at the end of the caching campaign is $1bn and PRIME price stays flat, the value of tokens at the end of the caching period would equal $3,118 as above.

However, consider the volatility of crypto – it is likely that PROMPT reaches an all-time high over the next 2 years, say at a $4bn FDV (similar to the FDV reached by VIRTUAL during the peak AI agent mania), before retracing back to a more reasonable $1bn FDV.

Buying $1k PROMPT in the open market today and selling at this local top would yield $8,000, more than 2x the value for caching PRIME.

Conclusion

Those looking to get exposure to PROMPT, whether to do it through max caching PRIME or just via open market purchase, should consider the following factors:

- What do you think the terminal value of PRIME and PROMPT is at the end of the 2 year caching period?

- What do you think the all-time high price of PROMPT will be over the next 2 years, and crucially, will you be able to sell this top?

Ultimately, this is very dependent on the individual. It is a fact that most investors are not able to sell a market top. At the same time, as many PRIME cachers have experienced, locking in your tokens for >2 years and seeing it draw down 90% is a gut wrenching feeling. Of course, I find it difficult to imagine that PRIME falls over 50% from here, given it is a leader in the web3 gaming space and has multiple catalysts ahead – including the release of the Colony and Sanctuary games both expected to occur this year.

Furthermore, the team is already thinking about creating new tokenomic levers to create $PRIME deflation and thus value accrual, giving me confidence that downside for the gaming token is limited from here:

I will end by stating that none of the above is financial advice, and I am not responsible if any of the above calculations are incorrect. I aim to be as transparent as possible in my calculations, always stating my assumptions, but I implore you to do your own research and test these assumptions yourself. Hopefully this helps market participants make a more informed decision on how to get exposure to Wayfinder.

DMD.

Disclaimer:

This article is reprinted from [X]. All copyrights belong to the original author [@Daveeemor]. If there are objections to this reprint, please contact the Gate Learn team, and they will handle it promptly.

Liability Disclaimer: The views and opinions expressed in this article are solely those of the author and do not constitute any investment advice.

Translations of the article into other languages are done by the Gate Learn team. Unless mentioned, copying, distributing, or plagiarizing the translated articles is prohibited.

Related Articles

In-depth Explanation of Yala: Building a Modular DeFi Yield Aggregator with $YU Stablecoin as a Medium

Exploring 8 Major DEX Aggregators: Engines Driving Efficiency and Liquidity in the Crypto Market

Sui: How are users leveraging its speed, security, & scalability?

What Is Copy Trading And How To Use It?

How to Do Your Own Research (DYOR)?